PCS - Invoice Receipts User Guide

1. Overview

This PCS – Invoice Receipts User Guide provides staff with detailed instructions on managing tax invoices, receipts, and related tasks. It covers functions such as creating and managing invoices, filing tax information, printing receipts, exporting data, and emailing invoices. The guide is designed to ensure clear, step-by-step instructions for effective use of the system in handling tax and receipt processes.

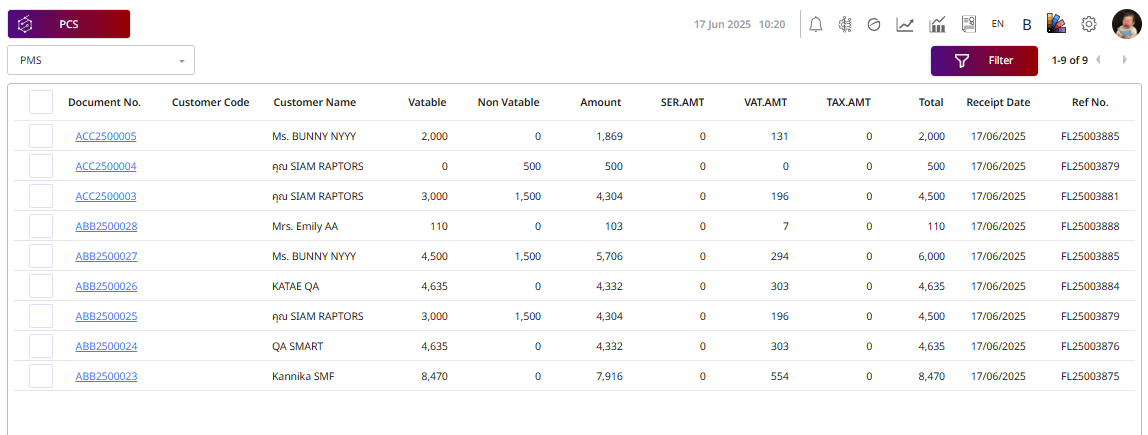

2. Invoice Receipts

Available under PCS > Invoice Receipts, this function allows staff to view a list of receipts and invoices issued to customers.

To perform the task:

- Select BU .(PMS, POS, etc..)

- Document No. — The receipt or invoice number issued by the system.

- ACC (Account Charge): Invoice issued for later payment, often for credit or corporate customers.

- ABB (Receipt): Issued when payment is received, typically after guest checkout or walk-in sales.

- Customer Code — Internal customer reference code (if available).

- Customer Name — The name of the customer receiving the document.

- Vatable — Amount not subject to VAT.

- Non Vatable — Amount not subject to VAT.

- Amount — Total amount before VAT and service charges.

- SER.AMT — Service charge amount (if applicable).

- VAT.AMT — VAT amount calculated from the vatable amount.

- TAX.AMT — Withholding tax amount (if applicable).

- Total — Final amount payable by the customer.

- Receipt Date — Date when the receipt or invoice was issued.

- Ref No. — Reference number for tracking in the financial system.

- Document No. — The receipt or invoice number issued by the system.

- Select Invoice receipt.

- Press Print to print the receipt or invoice.

Note: Ensure all receipt and invoice details are accurate to avoid discrepancies in customer billing records.

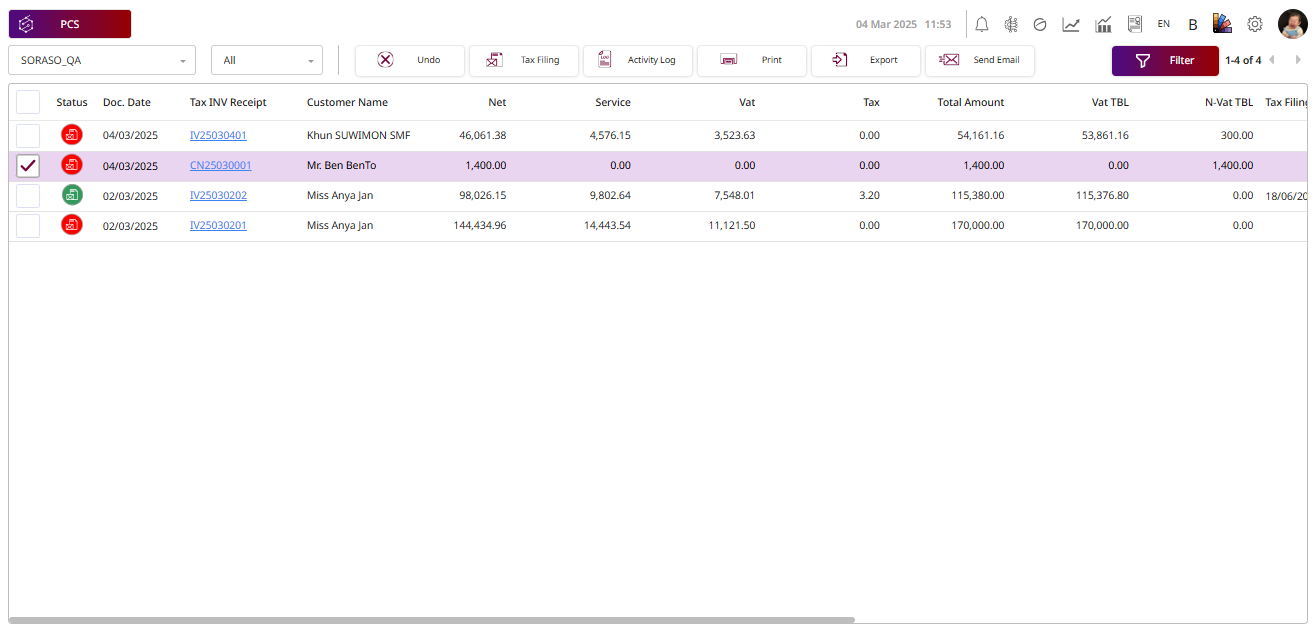

3. Tax & Receipt Center

Available under PCS > Tax & Receipt Center, this function allows staff to manage tax invoices and receipt-related tasks.

To perform the task:

- Select Hotel and BU. (PMS, POS, etc.. )

- Select Tax Invoice.

- This status means Invoice that has not been filed for tax purposes.

- This status means Invoice that has been filed for tax purposes.

- Select Undo to reverse the previous action.

- Select Tax Filling to mark the invoice as filed for tax purposes.

- Select Activity Log to view the log of actions performed on the invoice.

- Select Print to print the invoice.

- Select Export to export the invoice data.

- Select Send Mail to email the invoice.

- Select Undo Tax filling to reverse the tax filing action. (This option appears when the invoice has already been tax filed)

Note: Ensure accurate tax filing status. Undo Tax Filing is available only for invoices that have been tax filed.