BOS - General Ledger User Guide

1. Overview

The General Ledger (GL) system manages financial transactions for accurate reporting and decision-making. It includes account configuration, journal posting, recurring entries, and period closing. The system integrates with AP, AR, and Inventory modules to maintain financial consistency and control. With proper setup and workflows, users can ensure reliable and auditable financial records.

2. INITIAL CONFIGURATION

Initial configuration is essential before using the GL system. This includes defining chart of accounts, control accounts, fiscal year, and other system settings that affect all ledger transactions.

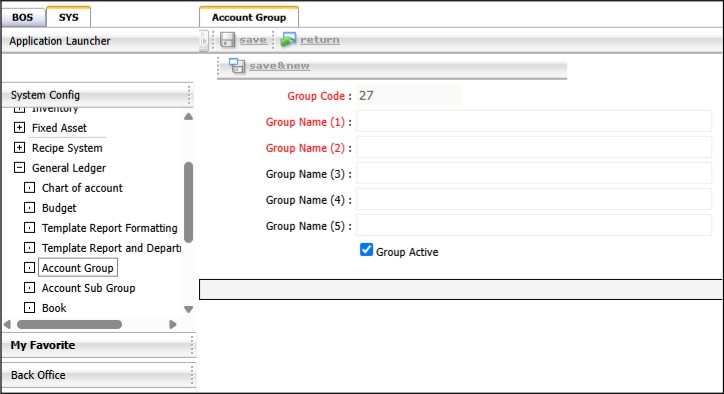

2.1 Account Grouping

This feature allows users to group accounts by specific criteria such as department, project, or cost center, supporting detailed analysis and report segmentation.

To perform the task:

- Go to SYS Tab → Back Office Master → General Ledger → Account Group

- Click "Add Group"

- Define group name and description

- Select accounts to include in the group

- Assign group codes if required

- Save the grouping

Note: Use clear naming conventions to simplify reporting and analysis.

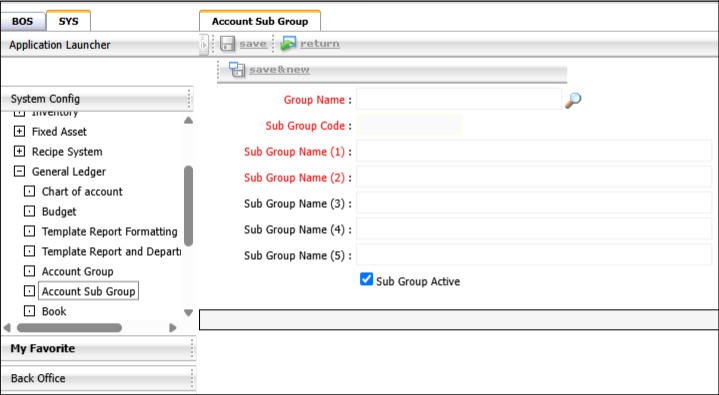

2.2 Sub Group Setup

This function is used to configure ledger categories, which help classify financial entries by source or function, such as operational, administrative, or project-based.

To perform the task:

- Go to SYS Tab → Back Office Master → General Ledger → Account Sub Group

- Click "New"

- Enter category name, description, and code

- Assign default accounts or rules for the category

- Save the setup

Note: Categories should align with organizational financial structure to facilitate budget tracking and expense control.

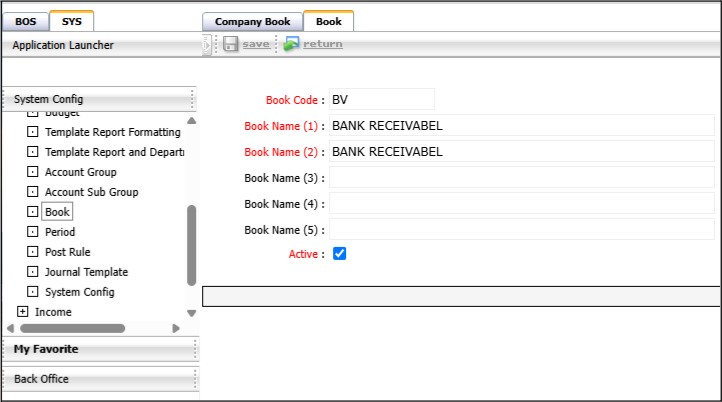

2.3 Account Book Configuration

Journal books are used to organize accounting entries by document type and frequency. This configuration helps manage journals for daily transactions, adjustments, and recurring entries.

To perform the task:

- Go to SYS Tab → Back Office Master → General Ledger → Book

- Click "New Book"

- Define journal name, description, and code

- Set numbering format and posting frequency

- Link journal book to corresponding GL accounts if required

- Save the journal book configuration

Note: Use separate journal books for major financial functions to enhance clarity during audits and reconciliations.

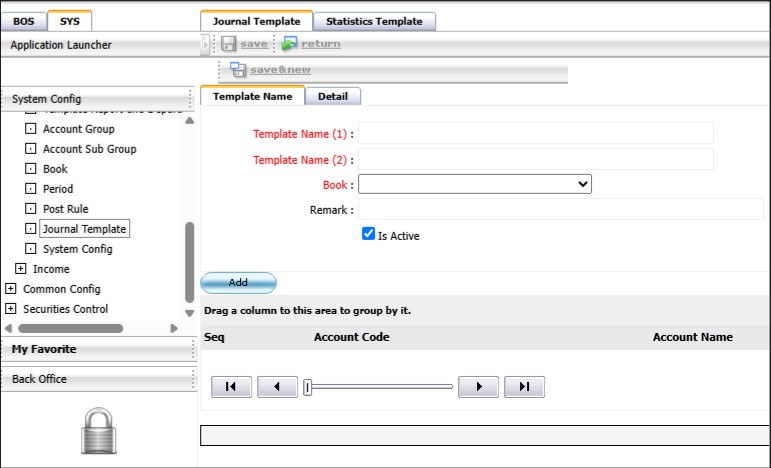

2.4 Account Formating

Control accounts are summary accounts used to reconcile sub-ledgers with the general ledger, typically applied to areas such as receivables, payables, or inventory.

To perform the task:

- Go to SYS Tab → Back Office Master → General Ledger → Journal Template

- Click "New "

- Define the template name

- Select Book type

- Save the setup

Note: Ensure the control accounts are reconciled periodically with the sub-ledgers to maintain accuracy in financial reporting.

3. Workflow General Ledger System

The Workflow Ledger System handles the end-to-end financial operations within the GL module, including posting, reversing, recurring entries, and period closing. It provides structured tools to ensure accurate recording, error correction, automation of regular entries, and secure period closure. These workflows help maintain integrity, consistency, and audit readiness in financial reporting.

3.1 Accounting

This feature enables users to perform ledger postings and adjustments through a structured interface. It supports operations such as posting journal entries, editing previously saved entries, and selecting specific chart of accounts for accurate financial documentation.

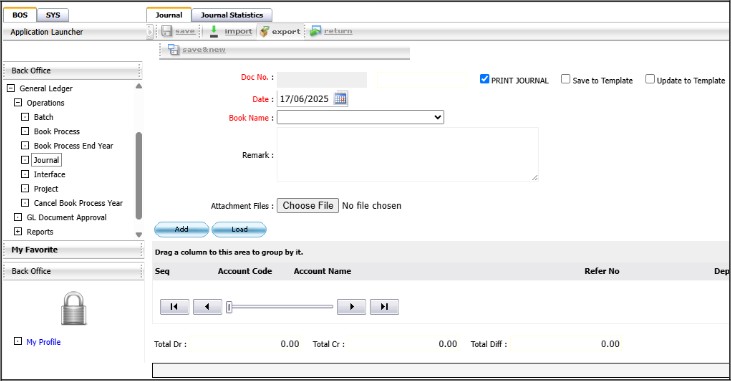

To perform the task:

- Go to BOS Tab → General Ledger → Operations → Journal

- The Accounting screen

- Click the "New" button to create a new posting

- To re-post an existing document, click the Re-post button

- Select the document date and journal book

- To save the journal as a template or edit a template, use the Template functions

- To enter accounts:

- Click on the line to search for a chart of accounts

- Enter account name or number, then click Find

- Double-click on the desired account

- Enter debit or credit amounts and notes

- To delete a line, press Delete or Clear Zero for zero balance lines

- After completing, press Save

Note: Ensure all debit and credit entries are correctly matched before saving to maintain ledger balance.

3.2 Data from Other Systems

This function allows users to retrieve and verify document sets sent from other systems before posting them to the General Ledger. It supports reviewing and approving data sets by type and date range and displays backlog records that have not yet been posted.

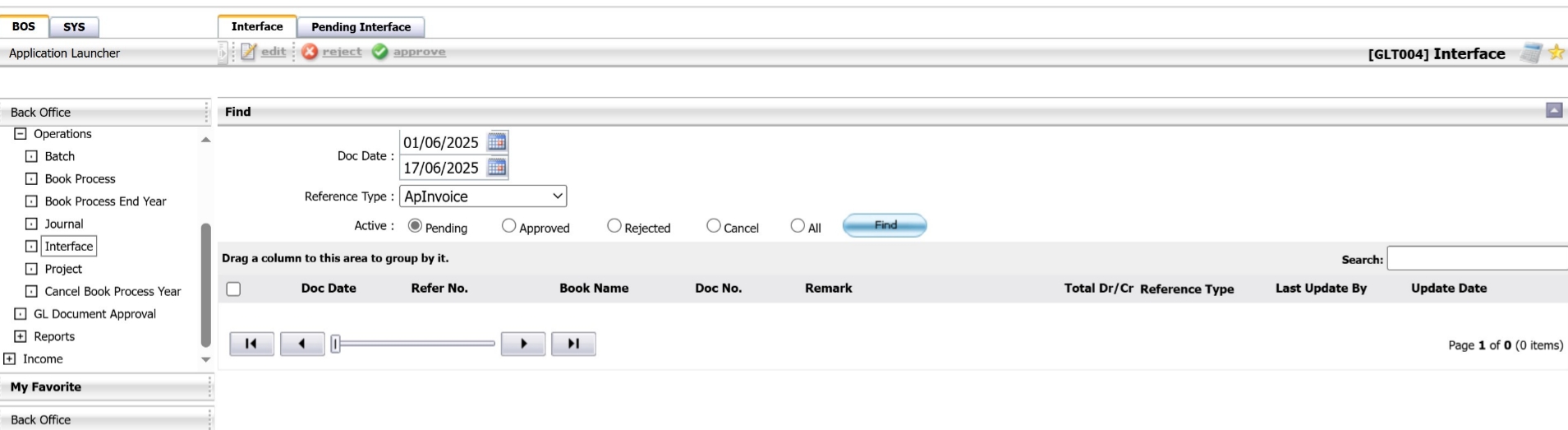

To perform the task:

- Go to BOS → General Ledger → Operations → Interface

- In the search section:

- Select the year and period.

- Enter the date range of the document set.

- Choose the document type.

- Click the Find button to search.

- The system will display a list of document sets marked for posting to GL.

- Check the box next to the desired document set.

- Click Approve to post the selected documents, or click Reject to return the document to the source system.

- After approval, the data will automatically proceed to BOS → Ledger → Execution → Posting.

Note: Review document details carefully before approving to ensure accurate GL posting.

3.3 Process the account book

This function processes the accounting books and sends data to the ledger system to generate various reports, including trial balances, profit and loss statements, and more. It also supports canceling a processed book when needed.

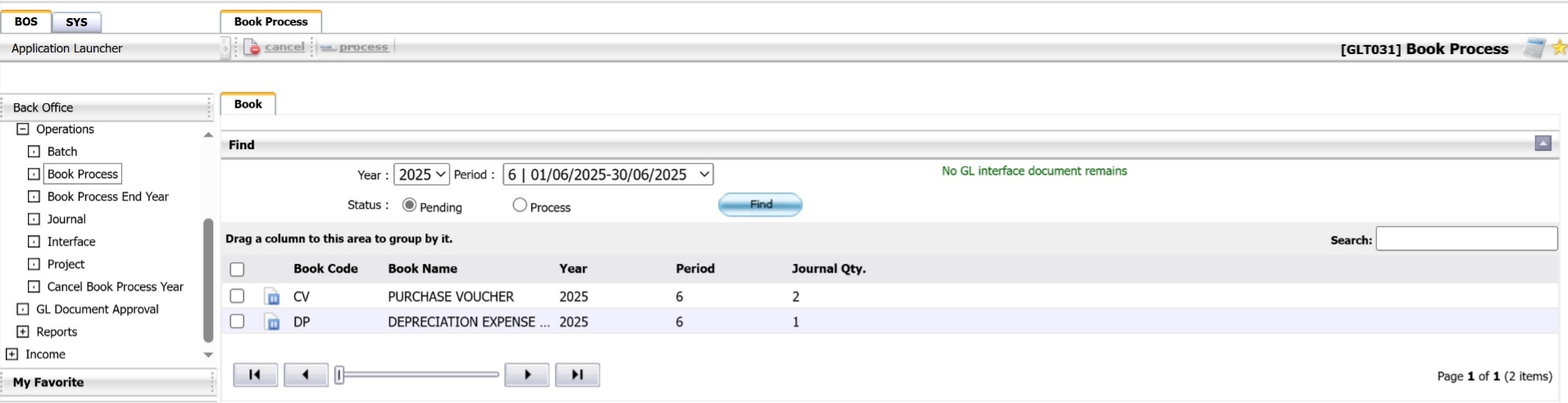

To perform the task:

- Go to BOS Tab → General Ledger → Operations → Book Process

- Select the desired year and period

- Click Find to retrieve the available books

- Check the box for the desired book

- Click Process to start processing; status will change from Pending to Processing

Note: Ensure the correct book and period are selected before processing or canceling to avoid incorrect reporting.

3.4 Income/Expense Deduction and Carry-over Only (GL-CutOff)

This function is used to close the month-end accounting cycle by generating a cut-off list of income and expenses. When no new transactions are recorded for the period, the system transfers income to retained earnings and carries expenses to the profit and loss account. It also supports year-end carry-forward for annual closing.

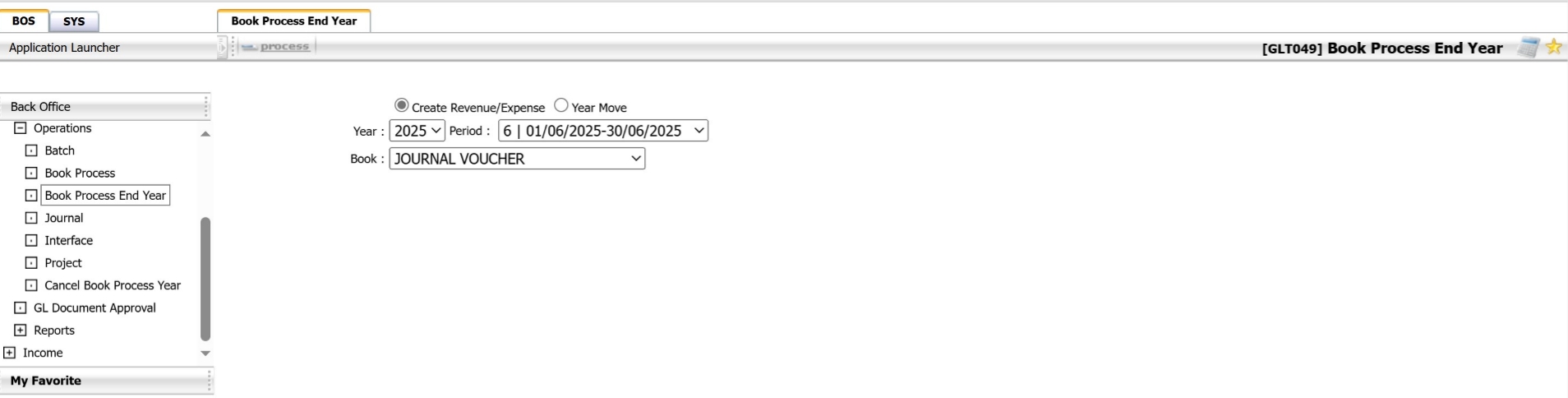

To perform the task:

Create a revenue/expense cut-off list

- Go to BOS → Ledger → Operations → Process the Book of Accounts

- Select the desired Year and Period

- Click the Process button

- A confirmation window will appear → Click OK to confirm or Cancel to abort

Carry forward over the year only

- Go to BOS → Ledger → Operations → Process the Book of Accounts

- Select the Cross-Year Carryover Only option by choosing the 12th period of the current year

- Click the Process button

- A confirmation prompt will appear → Click OK to proceed or Cancel to abort

Note: Use this function only after verifying that no further changes are required for the selected period.