E-Invoice User Guide

1. Overview

This E – Invoice in Vietnam is a legally recognized digital document issued, received, and stored electronically. It replaces traditional paper invoices and must follow formats and standards set by the General Department of Taxation (GDT) under the Ministry of Finance.

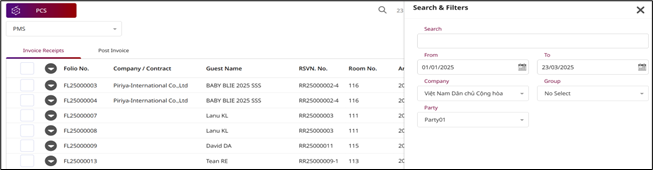

2. Filter (Invoice for PMS&POS)

The Search & Filters panel (right-hand side) allows refined searching.

Available Fields PMS:

- Search: Enter any keyword, guest name, folio number, or reservation number.

- From / To: Select the date range for invoice records.

- Company: Filter results by company name.

- Group: Filter by group category (if applicable).

- Party: Filter by party code or label.

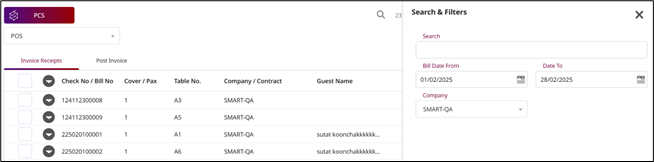

Available Fields POS:

-

Search: Enter any keyword, guest name, Check/Bill number, or Table number.

-

From / To: Select the date range for invoice records.

-

Company: Filter results by company name.

-

Press Search – Executes the search based on entered filters.

-

Press Reset– Clears all search fields and displays the default list.

Note: Ensure the correct date range is selected to avoid missing records.

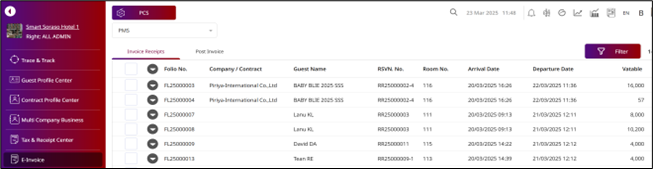

3. E-Invoice for BU PCS

Available under Bu PCS > E-Invoice > Select PMS > Invoice Receipts, this screen allows users to view and manage invoice receipt records that are typically imported from the PMS (Property Management System). These receipts include folio transactions associated with guest stays, which may or may not have generated tax invoices yet.

3.1 PMS - Invoice Receipts – View receipts.

Table Display page.

Column : Description

- Folio No. : The folio number from the PMS (guest billing record).

- Company / Contract : Guest’s company name or contract type.

- Guest Name : The full name of the guest.

- RSVN. No. : Reservation number.

- Room No. : Room number assigned to the guest.

- Arrival Date : The guest checked in.

- Departure Date : The guest checked out.

- Vatable : Amount that is subject to VAT (taxable portion).

- Non-Vatable : Amount that is not subject to VAT.

- Amount : Subtotal amount (usually excluding service charge and VAT).

- Service Amount : Amount charged as service fee.

- VAT Amount : Value-added tax amount.

- Tax Amount : Total tax (if applicable).

- Total : Combined amount including taxes and service fees.

- Invoice : Amount Total amount already invoiced.

- No Invoice : Amount Pending to be invoiced.

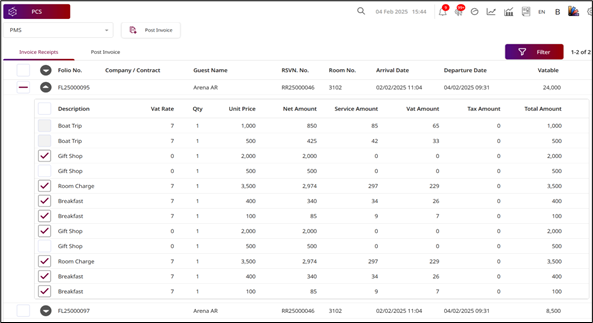

To perform the task:

- The system retrieves charges from the PMS folio (e.g., FL25000095).

- Users can tick/untick specific line items to include in the E-Tax invoice.

- Amounts are auto-calculated based on VAT and service charge rules.

- Once selected, you can click “Post Invoice” to generate an e-invoice for those charges.

Note: This screen displays the detailed folio line items associated with each guest’s stay, allowing the user to select specific charges to generate an E-Tax Invoice.

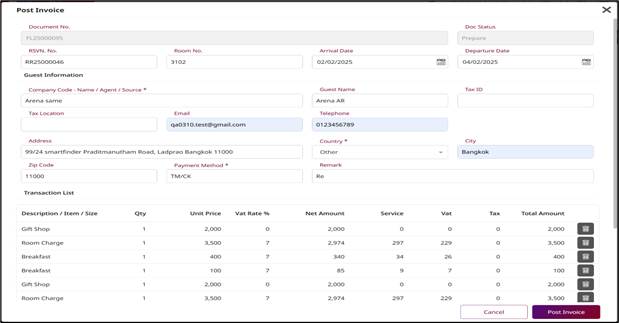

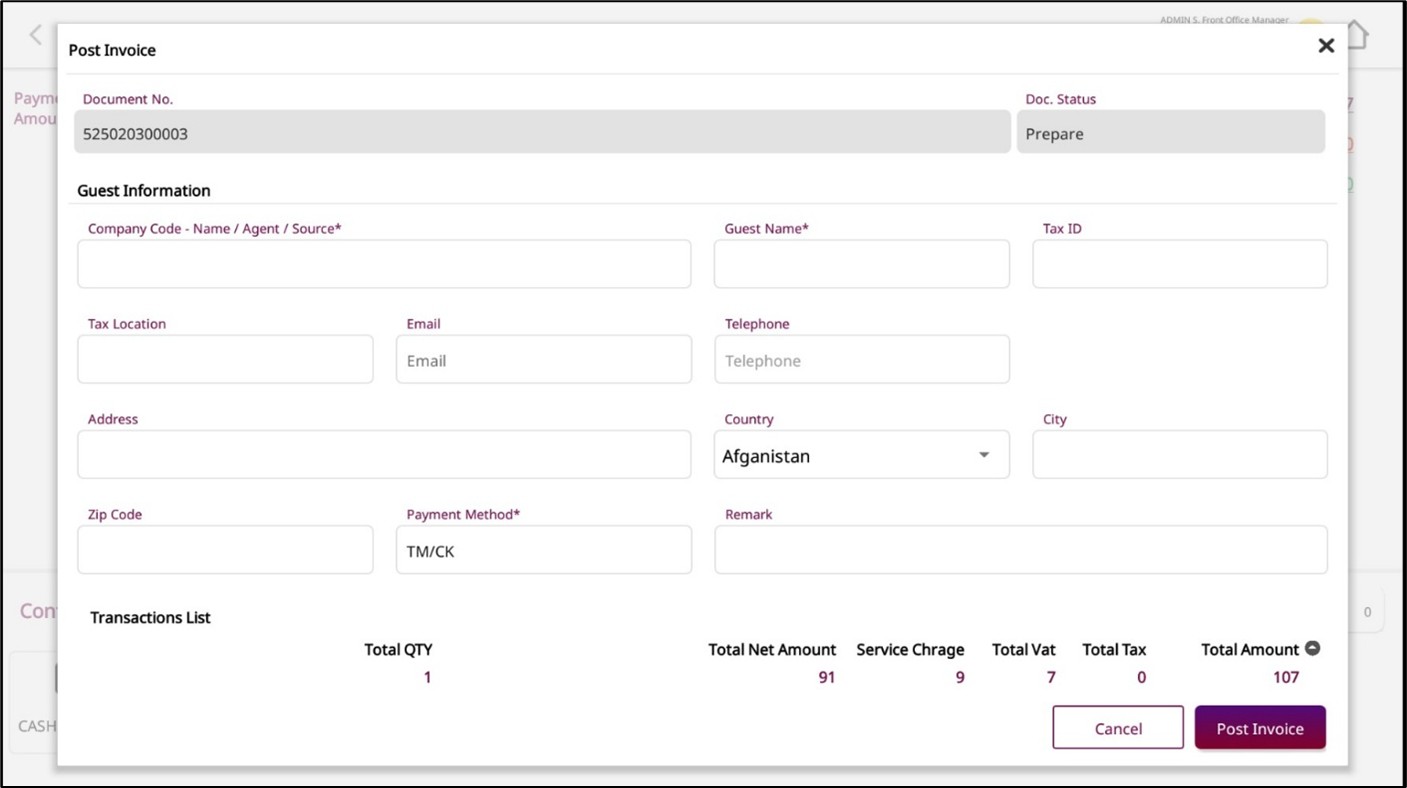

To perform the task:

-

Document Section

Document No.: Auto-generated and non-editable invoice number.

Doc Status : Indicates the status of the document. (e.g., Prepare)

-

Reservation Details

RSVN. No. : Reservation number linked to the guest's stay.

Room No. : Room number assigned to the guest.

Arrival Date / Departure Date: Check-in and check-out dates.

-

Guest Information

Fill in or verify guest-related details:

- Company Code - Name / Agent / Source*: Required field. Name of the company or booking source.

- Guest Name: Name of the guest.

- Tax ID (if applicable) : Guest or company tax identification number.

- Tax Location (if applicable) : Tax location if different from guest address.

- Email / Telephone: Contact information for the guest or company.

- Address / Zip Code / City: Mailing address, postal code, and city.

- Country*: Required. Select the guest's country.

- Payment Method*: Required. Method of payment (e.g., TM/CK, Credit Card).

- Remark: Any additional notes or remarks.

- Transaction List: This section shows all posted items and charges

- Post Invoice : Confirms and finalizes the invoice. Once posted, the invoice is recorded in the system.

- Cancel : Cancels the process and closes the screen without saving changes.

Note: Once confirmed, the invoice can be posted and recorded in the system.

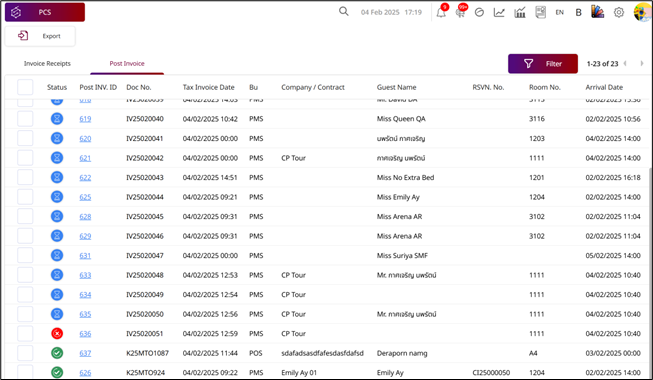

3.2 PMS - Post Invoice – View tax invoices.

Table Display page.

Column : Description

- Status : Shows the processing status of the invoice (icons explained below).

- Post INV. ID : Internal reference number of the invoice in the PCS system.

- Doc No. : Official invoice document number (e.g., IV = Invoice, CN = Credit Note).

- Tax Invoice Date : The issuance date and time of the tax invoice.

- Bu : The source system (PMS or POS).

- Company / Contract : Name of the guest’s company or contract type.

- Guest Name : Name of the guest/customer.

- RSVN. No. : Reservation number.

- Room No. : Room number assigned to the guest.

- Arrival Date : The guest’s check-in date.

- Departure Date : The guest checked out.

- Vatable : Amount that is subject to VAT (taxable portion).

- Non-Vatable : Amount that is not subject to VAT.

- Amount : Subtotal amount (usually excluding service charge and VAT).

- Service Amount : Amount charged as service fee.

- VAT Amount : Value-added tax amount.

- Tax Amount : Total tax (if applicable).

- Total : Combined amount including taxes and service fees.

- Payment Method : The type of payment used by the guest for the transaction

- Ref No. : Document Running number (e.g., ABB123)

- Action Date : The date when a specific action was performed (e.g., invoice posted)

- Remark : Any additional notes or remarks.

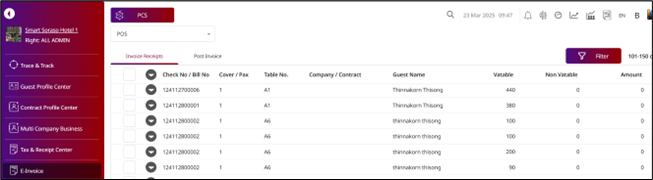

Available under Bu PCS > E-Invoice > Select POS > Invoice Receipts, this screen displays all POS invoice records. Users can review key details such as bill number, number of guests (Cover/Pax), table number, guest name, taxable and non-taxable amounts, and the total amount for each transaction. This helps in tracking sales, verifying billing information, and preparing reports.

3.3 POS - Invoice Receipts – View receipts.

Table Display page.

Column : Description

- Check No / Bill : No Amount that is subject to VAT (taxable portion).

- Cover / Pax : the number of individual bills or service covers for the transaction.

- Table No. : Table No. the order came from. (e.g., A1, A2)

- Company / Contract : Name of the guest’s company or contract type.

- Guest Name : Name of the guest/customer.

- Vatable : Amount that is subject to VAT (taxable portion).

- Non-Vatable : Amount that is not subject to VAT.

- Amount : Subtotal amount (usually excluding service charge and VAT).

- Service Amount : Amount charged as service fee.

- VAT Amount : Value-added tax amount.

- Tax Amount : Total tax (if applicable).

- Total : Combined amount including taxes and service fees.

- Invoice Amount : Total amount already invoiced.

- No Invoice Amount : Pending to be invoiced.

To perform the task:

- The system retrieves charges from POS Check No./Bill No. (e.g., 1024012200054 )

- Users can tick/untick specific line items to include in the E-Tax invoice.

- Amounts are auto-calculated based on VAT and service charge rules.

- Once selected, you can click “Post Invoice” to generate an e-invoice for those charges.

- The system operation is the same as 3.1 and 3.2.

Status Icon

“Publish” status means the invoice has been posted.

“Prepare” status means it is waiting to be posted or canceled.

“Cancel” status means the invoice has been canceled.

Note: Once posted, changes to the invoice may require approval or a new document.

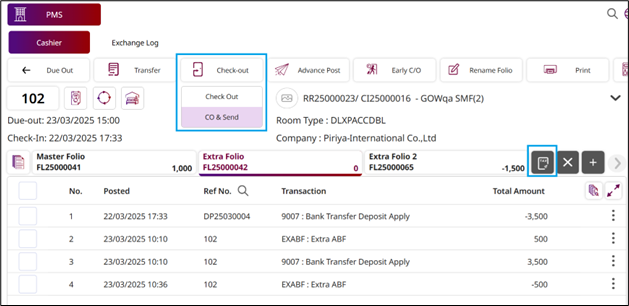

4. How to Close & Send a Folio Invoice the Cashier screen (PMS).

Available under Cashier > Room List > Select Room No. , this function The Close & Send & CO & Send function in the Cashier screen is used to finalize a guest’s folio, ensuring the balance is zero, and send the invoice directly to the designated recipient. Once a folio is closed, no further transactions can be posted to it. This feature streamlines the check-out process by combining folio closure and invoice delivery in a single action.

To perform the task:

-

Open the Cashier Menu

From the PMS main screen, click Cashier.

-

Select the Room

Choose the room for which you want to send the invoice.

-

Go to the Folio Tab Click the Folio tab. Note: Sending is only possible when the folio balance is 0.

-

Close & Send the Folio

Click the Close & Send icon to send only the selected folio. Or

Click the CO & Send button to post the invoice.

-

Review Invoice Details

The system will display a form to enter necessary information and show all item details.

-

Confirm Posting

Click Post Invoice to confirm and complete the posting process.

-

Cancel if Needed Click Cancel to discard changes and close the pop-up without sending.

-

Finalize in BU PCS

After confirming that the invoice has been successfully posted, select BU PCS to complete the process.

Note: CO & Send – Check-out and send confirmation or invoice. Close & Send – Close Folio and send confirmation or invoice.

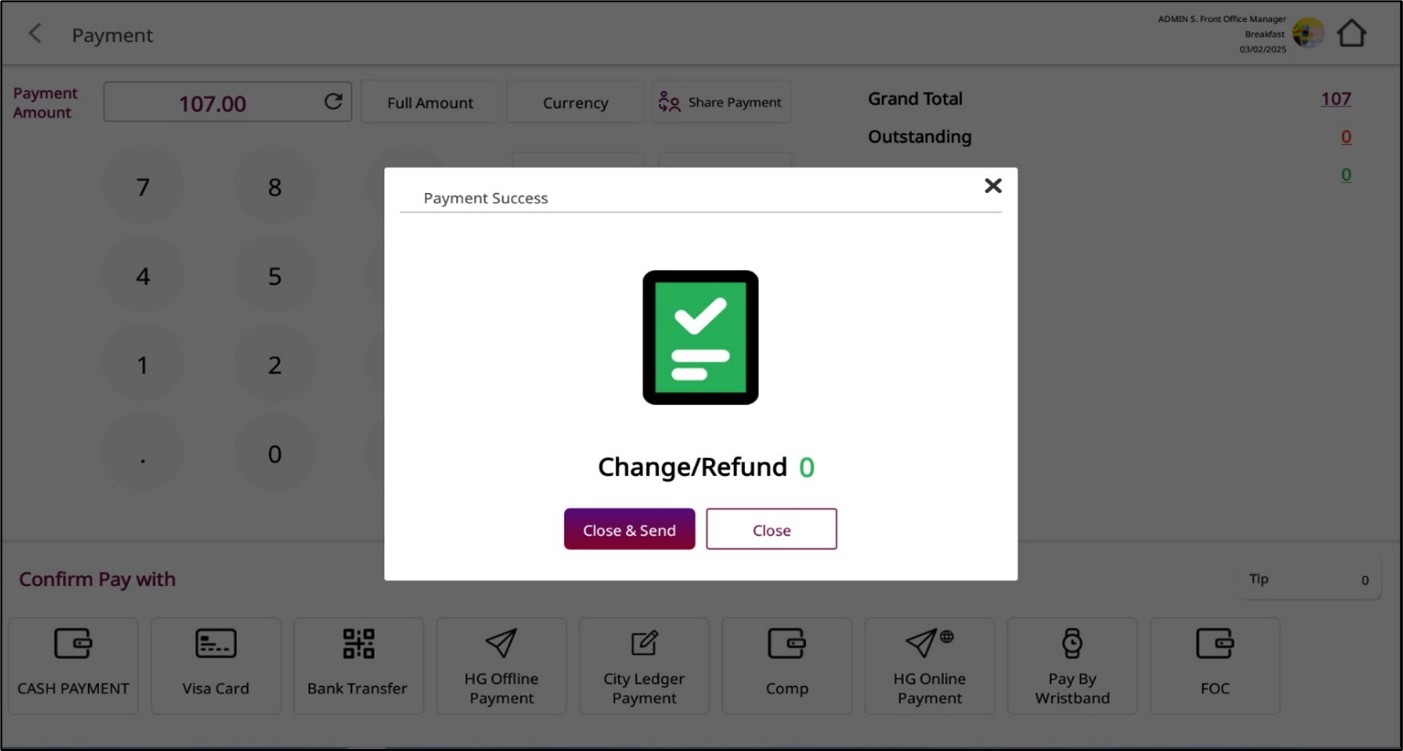

5. How to Close & Send Invoice the Cashier screen (POS).

Available under Cashier > Payment > Confirm Pay , after completing payment in the POS cashier screen, the system will display a “Payment Success” confirmation pop-up. From here, you can finalize and send the invoice to the E-Invoice module.

To perform the task:

-

Go to the Cashier Menu

Open the POS cashier interface where active bills are listed.

-

Select the Bill/Invoice

Choose the invoice you wish to close and send from the list.

-

Verify Details

Check guest name, table number, and amounts (taxable and non-taxable). Ensure the bill is correct and complete.

-

Close the Invoice

Click the Close & Send icon or button.

This action will finalize the bill, preventing further edits.

-

Send to E-Invoice

Once closed, the system will automatically send the invoice data to the E-Invoice module for record-keeping and/or tax submission.

-

Confirm Completion

The invoice will no longer appear in the “Open Bills” list and will be listed under “Close” records popup.

Note: Closed and successfully submitted invoices are removed from the open transactions list and appear in the invoice receipt record.

POS - Post Invoice – View tax invoices.

Table Display page.

Fields : Description

- Document No. : Auto-generated invoice number.

- Doc. Status : Current processing status (e.g., Prepare).

- Company Code / Name / Agent / Source* : Identification for corporate or agency billing.

- Guest Name : Name of the customer (mandatory).

- Tax ID : Customer’s tax identification number for tax invoice purposes.

- Tax Location : Applicable tax location code.

- Email : Guest or company email address.

- Telephone : Guest or company contact number.

- Address / Country / City / Zip Code : Customer’s billing address.

- Payment Method : Selected payment type (e.g., Cash).

- Remark : Any additional notes.

-

Post Invoice

Confirms and sends the invoice to the E-Invoice system.

-

Cancel

Closes the form without saving changes.

-

Finalize in BU PCS

After confirming that the invoice has been successfully posted, select BU PCS to complete the process.

Note: Ensure all mandatory fields (marked with an asterisk *) are completed before clicking Post Invoice.